When starting a new product initiative, it is drilled into our heads by all the great product thinkers that we must think about risk. What are the assumptions we are making? Which are the riskiest? How can we reduce the risk inherent in each of those assumptions early?

Most of our attention falls into the 4 types of risk described by Marty Cagan as:

-

Value Risk

-

Usability Risk

-

Feasibility Risk

-

Business Viability Risk

Alternative models collapse these into Desirability, Feasibility, and Viability. Whatever unknowns you wish to solve for, the associated risks are all addressed through Discovery processes. Sometimes we hit a wall and pivot. Sometimes we need to kill an initiative before wasting any more scarce resources.

I want to take a step back and consider the decisions we can make that might impact the scale of the Discovery Risks entirely. Unfortunately, reducing these risks has an equally challenging trade-off.

Excelling at Product Execution

I believe that we have a significant option when bringing new products to the market. We can decide to go after the unknown and embrace the risks by conquering the discovery process. This is what most product management thought leaders focus on and what the best product management training teaches.

However, another alternative is to copy an existing successful product business with the aim to out-execute them along the way to stealing a significant segment of the addressable market.

If one or more companies are already successful in a particular product category you have dramatically reduced discovery risk. You know there is a valuable problem worth solving. Further, you know it is possible to create a usable solution, technical issues are clearly solvable, and it is possible to create a viable business model around it.

If you simply seek to replicate the incumbent business, the core challenge you are now attempting to tackle is that of executing better than the existing alternatives.

A survey of any established product category will yield multiple vendors supplying competitive offerings. Whether they are web browsers, email marketing tools, CRMs, or basic checking accounts. So clearly, many market needs are so great that there is room for multiple providers to solve even in non-differentiated ways.

So Why Isn’t Everyone Just Building Me-Too Products in big Markets?

The core challenge with building a me-too product is that out executing incumbents is very difficult to do, especially as a startup. If tomorrow, I decided to start a company as a WordPress hosting provider, I would enter into a category that is well-defined by the existing products. Customers in the market have a set of minimum features they will expect any viable competitor to cover before considering the additional differentiators.

This is a problem that companies entering the market for Product Management software are facing now. To be viable as a Product Management Solution you must support Ideation, Discovery, multiple Prioritization Frameworks, Roadmaps, and a hook into common development management tools like Jira. Meeting all of these baseline requirements entails significant investment before you can attempt to capture large parts of a competitive market. For many startups, this initial cost is too great to contemplate.

One recent company that has done well using the out-execute approach is Zoom. The market for video conferencing software is dense with major players like Cisco, Google, and Microsoft after some years of consolidation. Eric Yuan, left Cisco WebEx and founded Zoom in 2011. Starting with 40 engineers that came over from Cisco WebEx they built the first release in over a year. (I can’t find the reference but recall hearing on a podcast it took nearly 2 years of development to get the first release out.)

Think about that. A startup that had long-standing deep market insight, internal knowledge of weaknesses of the largest incumbent, and a massive development team that could work heads down for nearly 2 years before releasing anything. This type of opportunity is not present for most startups entering an existing product category.

Zoom had the ability to out-execute through a focus on this space and significant investment financing their efforts.

Out Executing is Usually Not Enough

Despite having all of these advantages, even Zoom looked for room to innovate. It was in the user experience, integration, and freemium business model. These aspects helped propel them past me-too status.

Basically, they made some strategic decisions on how to balance discovery and execution. While they out-executed they also out-innovated in discovering a product design that was more user-friendly and a business model that created a massive marketing funnel no other video conferencing vendor had.

This balance between discovery and execution is a critical aspect of product strategy. Rare is the new product that goes entirely to one end of the spectrum.

Where are you on the Execution v. Discovery Focus Spectrum?

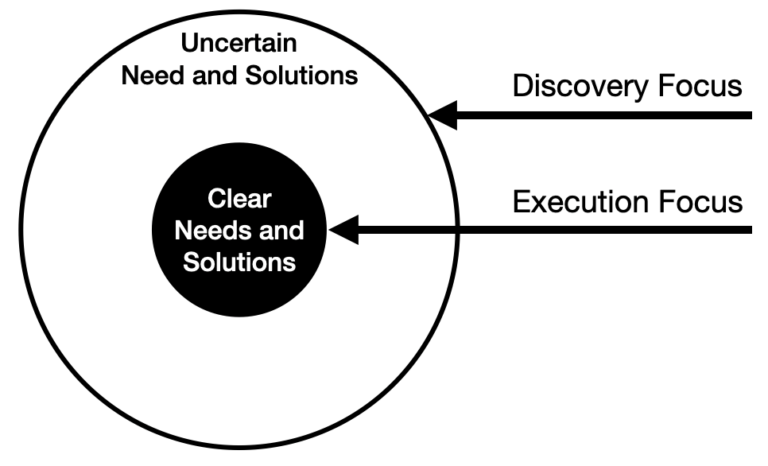

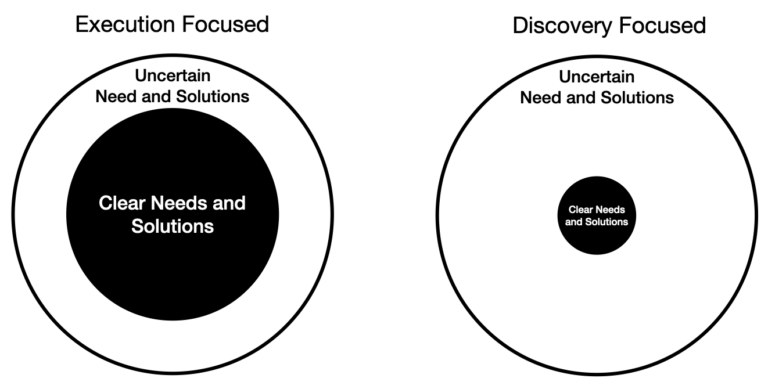

Assessing where your new product initiative sits on the spectrum of execution-focused versus discovery focused is pretty straight-forward.

Execution focused new products exist where there are clear competitors and a fairly well-established market need.

Discovery focused new products exist where the potential customers aren’t sure what solutions are available. If they are using something, homegrown or not for the purpose it was built, the customer/users generally recognize significant deficiencies but have decided it is the best option available.

So while execution-focused new products remove a lot of uncertainty they create a massive obstacle to becoming minimally viable. Discovery focused products encounter substantial risks but offer the potential of a greenfield to dominate if they successfully innovate.

In practice, many new product categories are displacing a hodgepodge of solutions customers have made do with for years. The challenge then, for Product Strategists, is to determine the right balance of out executing these weak solutions versus focusing on the innovations that are designed to directly solve the market needs.

To make matters more challenging, the incumbent solutions, since they are not really purpose-built, are usually offered at low price points. So the new innovation must not clearly demonstrate greater value in order to eliminate price pressure.

Shifting Along the Continuum

A simple thought exercise for shifting your product along the Execution Focus v. Discovery Focus spectrum is to simply change the scope of the problem you are considering to solve.

Move toward execution focus by investing more attention analyzing existing solutions in a product category identifying valuable gaps underserved by the incumbents through a broad market survey. This will decrease uncertainties and enable greater focus on execution. Good market research and solution discovery will uncover the underserved needs with the highest likelihood of success. This path can work well if you have substantial resources to compete. Assume the incumbents also know about these gaps so out-executing is key.

Example: Superhuman and Hey email services see a gigantic email market with significant weaknesses not well addressed by major incumbents. Both had to tackle lots of me-too basics before investing in the extra bits that differentiate their offerings into valuable services.

Move toward discovery focus by investing more attention in potential customers and deeply understanding their valuable unmet needs. Reduce your risk by minimizing the scope of what defines a customer segment. The narrower the focus the smaller the investment will be needed to discover a solution that achieves product/market-fit.

Example: Slack saw massive problems in the incumbent email services but took a step back to broaden the problem space being considered. In so doing, they discovered a significant unmet need for rapid communication in corporate environments. As they came up with a solution, they recognized that it could effectively replace email for many common use cases. While designing a novel solution in a new product category, they didn’t need to start by matching existing email service features before having something viable.

Product Lifecycle

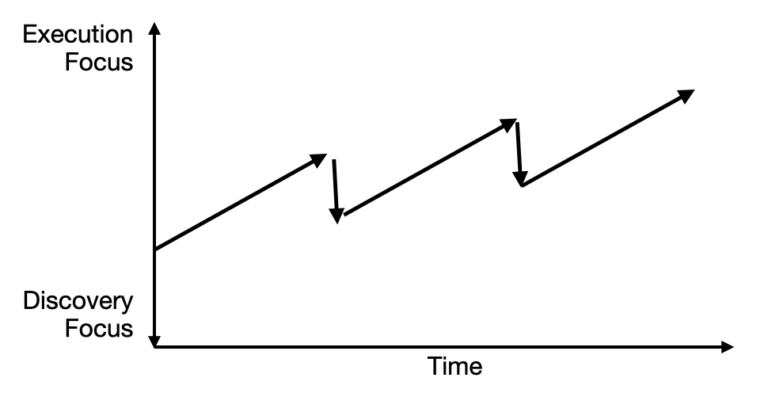

Lastly, new products start in one place on the continuum but will tend to shift over time. As the product and category mature, more knowledge of the market and problem space will be developed. This will reduce uncertainty and drive a need for product strategies focused more on execution over time.

In the diagram below you can see that wherever you start on the spectrum, you will trend toward execution-focused overtime. However, periodically market conditions and other factors will demand a shift toward higher discovery focused activities.

The diagram is intended to highlight a common pattern over-time but identifying where to start and where break-points are encountered will vary. The key is to be aware of these shifts and ensure you are leaning into them. As a market matures don’t over-invest in problem discovery. However, be on the look-out for market events that could demand increased attention to problem and solution discovery.

Conclusion

As I embark on my own startup, I wanted to share this observation I have had from many years of product management. It is likely that some experts out there will think I am a heretic for suggesting that sometimes you take the foot off the discovery pedal, but in real life, we have scarce resources and attention.

I am here to say, especially in startups, you need to make tough choices on where to focus your energy. I believe that startups have a better chance of success by focusing on new (or newer) product categories where there are lower initial expectations to gain a toehold into customers with a real unmet need. To find that requires a great discovery approach.

However, if somehow you woke up with piles of money and time for your startup (or new product) to succeed, like Zoom, then an execution-biased approach is also viable. It doesn’t remove your risks, it just changes the balance away from the 4 big risks toward things like hiring, marketing, and development execution.