Understanding the competitive landscape you operate in is a key part of your product positioning and overall strategy. We have many models for performing this analysis such as SWOT Analysis, Porter’s Five Forces, and Lean Canvas.

These are all fantastic at forcing us to think through a variety of internal and external factors that will impact our ability to succeed. However, I have another simple tool that you can use to accomplish some of the same objectives: Four Quadrant Positioning Analysis.

What is a Four Quadrant Positioning Analysis (FQPA)?

Four Quadrant Positioning Analysis is a tool for grouping competitive alternatives in a given market to see uncover insights into how they are positioned. By identifying vendors/products with similar characteristics you can uncover patterns of competitive behavior likely to occur based on how others in a given quadrant are also acting in the market.

To perform this analysis, first, identify the two most important criteria in a market. Second, identify competitive alternatives and place them in the quadrant that best reflects an understanding of their approach in the market. For each quadrant, defining a segment, you can give them a name for easy reference that highlights common positioning behavior.

Determining the two most important criteria is a matter of market research. In fact, there may be more than two criteria, so it is worthwhile to test different models. These coupled with other competitive analysis tools will give you the best insights.

Tip: When assessing competitors keep the criteria as simple (e.g. true/false) rather than value scales (e.g. 1-10). You will uncover insights quickly this way and can always go back to add granualrity later if it seems useful.

Putting Theory to Practice

For the purpose of illustration, I am evaluating a handful of AI vendors that operate in compliance and risk management markets. To conduct this analysis I could look at a number of criteria but have chosen two that have a great deal of positioning.

Technology Led versus Business Problem Focused

Frequently in rapidly advancing fields of science and technology, you will find startups that are created around a technological advance waiting for the killer app. Recently big data technology, blockchain, and augmented reality have all created a proliferation of startups that advance the technology in the hope of discovering their killer app. Eventually, some of these companies find traction and valuable market demand to satisfy.

Artificial intelligence is another such promising technological advance. Frequently, AI companies that fit this mold, were founded by academics that have invested a large amount of time in the research of particular fields of artificial intelligence. This research could be computer vision, unsupervised learning, NLG, etc. With this expertise, they set out to find a valuable market and build a technology product to unlock its value simultaneously.

At the other extreme are companies that focus on identifying a substantial market need then identify innovative approaches to solve those needs. These can be forward-looking incumbent solution vendors that effectively overcome inertia to lead disruptive industry change.

More often, with major advances, these can be new startups that overcome incumbents stuck with solutions based on old paradigms and technology. Uber, for example, is believed to have been born of the founders’ frustration with not being able to hail a taxicab one winter night in Paris. Knowing there had to be a better way to provide “a fast & efficient on-demand car service” they set out to leverage all the latest technologies to solve this problem.

Variety of AI techniques in use

It is difficult to identify vendors that claim to only use one form of AI or a specific algorithm in their products. However, there is a clear distinction between vendors that talk about their depth of expertise in a single field of AI and those, on the other hand, that focus on an open platform to support anything a data scientist wants.

The former company type focuses on a specific area of AI expertise, and will often have multiple patents and patents pending related to this significant intellectual property of theirs. For these vendors, this core IP is the critical company asset and they must identify market needs that it uniquely solves better than other alternatives.

The later company, that is open to leveraging whatever advances in AI make sense, will more often tend to provide a more flexible open platform for solving problems that can incorporate their algorithms, customer creations, and third party open source technology as well.

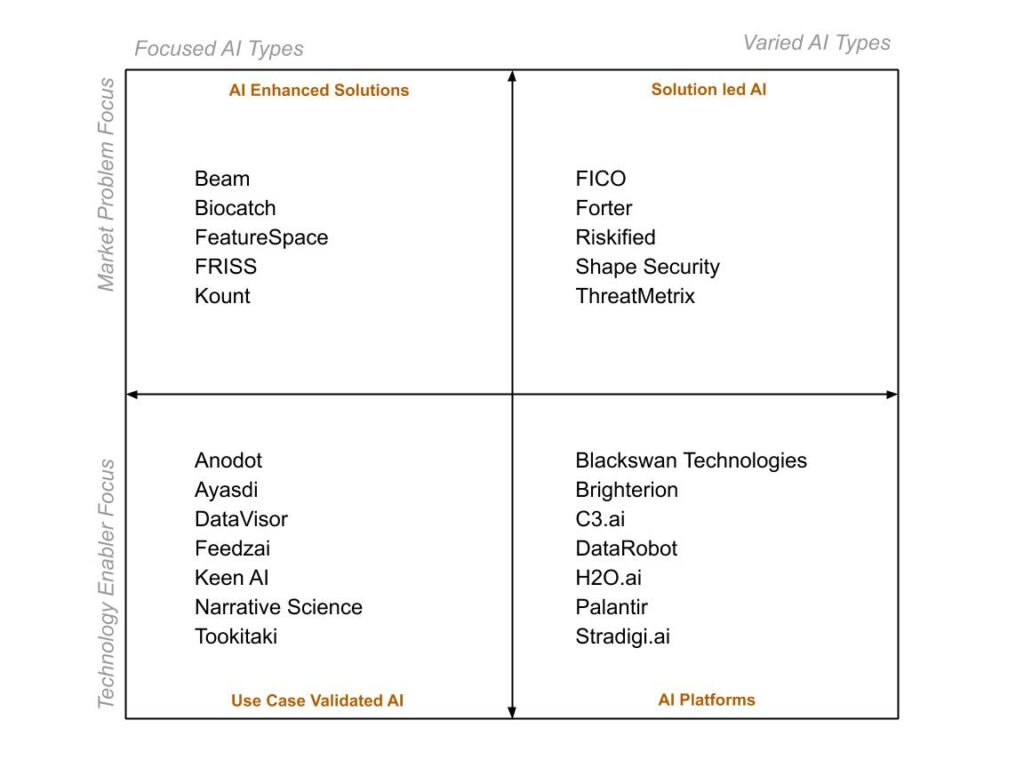

FQPA: AI Solution Driver vs. AI Focus

Here is what my Four Quadrant Positioning Analysis looks like with some select vendors filled in. I have labeled each quadrant with a short name to capture the basic business models reflected by each. Given a background understanding of the competitive alternatives, you can see immediately start to think about similarities in the challenges and opportunities vendors face that reside within each quadrant.

AI Enhanced Solutions

AI Enhanced Solutions are those that lead their messaging with a discussion of the business problems faced in their chosen market. Many vendors in this quadrant are more than 10 years old and have recently identified specific types of artificial intelligence or machine learning that can improve upon the solutions they are bringing to market.

These vendors are typically not discussing the specific class of artificial intelligence employed nor are they touting a list of patents. Their marketing focuses on how they deliver a better solution to very specific market problems.

By focusing on solving business problems, these vendors are not locked into specific types of AI and are free to continuously explore open source and proprietary analytics, that can improve their delivered business value.

Positioning Example: Featurespace | Featurespace is the world’s leading provider of Adaptive Behavioral Analytics technology for fraud and risk management.

Solution Led AI

The vendors in this quadrant where their AI investment focus like a badge of honor. They want their customers to know they invest heavily in innovative analytics that is the reason why they are uniquely positioned to solve their business problems.

While many of these vendors leverage a multitude of analytics approaches within their solutions, they remain ultimately focused on solved specific market problems. The advantage of leveraging many approaches is they learn how to be flexible and incorporate whatever the most promising approach is to solve each discreet problem.

Some vendors, particularly in the anti-fraud for the e-commerce market, are so confident in their ability to solve the core business problems that they offer chargeback guarantees. However, they demonstrate their confidence in delivering value, vendors in this quadrant predominantly started with advanced analytics as a core feature of their offering and organizational design.

Positioning Example: Riskified | Riskified is Working to Stop Fraud and Grow Ecommerce Revenue

AI Platforms

Platforms have very different users and buyers than solutions. They are marketed to appeal to those technology or data science organizations that are tasked with providing a center of excellence for the entire company or a specific area, like marketing or compliance.

AI Platforms must, therefore, demonstrate their flexibility in supporting a number of business needs while providing a technology stack that both aligns with their analytics needs and future technology vision. It is easy to identify such solutions as they lead with technical information about their platform followed by many examples of “use cases” in multiple industries in which it can be applied.

To be successful these vendors need to support a large number of potential use cases, thereby future-proofing customer investments. They need to demonstrate both visionary technology leadership and be desirable for teams to work on them. As such, expect a lot of resources and market outreach focused on education and developing a large, vocal user-community.

Leveraging an AI Platform to solve a specific business problem requires additional supporting integration and development to complete a system. As such, you will also find the broadest technology and delivery partner ecosystems develop around platforms to help customers realize their fullest potential.

Competition is fierce but the belief is this unlocks the broadest market potential. They rely on the broad ecosystem to continuously discover new use cases that the vendor can then leverage in a virtuous marketing loop.

Positioning Example: C3.ai | C3.ai is a leading enterprise AI software provider for accelerating digital transformation. The proven C3 AI Suite provides comprehensive services to build enterprise-scale AI applications more efficiently and cost-effectively than alternative approaches. The C3 AI Suite supports the value chain in any industry…

Use Case Validated AI

Many AI vendors start in this quadrant with deep expertise around one or a few types of algorithms. These vendors can frequently be identified by their emphasis on founders with impressive academic credentials in mathematics.

Their first business goal is for them to discover and validate, through market research, the ideal market needs for their AI to help address. While these vendors, like AI Platforms, focus on use case discovery, it is frequently more on them directly as no large developer ecosystem exists.

As use cases mature, vendors will begin to narrow focus on a subset that is then marketed as “solutions” to emphasize their domain expertise based on prior experience delivering into specific industries and use cases. However, they always hedge their bets by providing an option to develop custom use cases using their technology stack.

No vendor wants to stay in this quadrant despite starting out here. It is not an efficient way to develop a scalable business and would reflect an inability to learn from market insights. For a business that continues to thrive, one of the following must happen:

- Move to AI Enhanced Solutions. As specific use cases validate market demand, the vendor will invest in building out more complete solutions that fit their AI. This starts with deeper research into specific market needs and responding with complementary capabilities. The AI then becomes a critical feature of their solution differentiating it from competitive alternatives.

- Move to Solution Led AI. Through the discovery of validated market opportunities, these vendors frequently find a need to expand the variety of AI necessary to provide the most effective solutions. Vendors need to untether themselves from their original core AI strength which frees them from an arbitrary constraint on designing the best possible market solutions.

- Move to AI Platforms. During market discovery and validation, vendors must continue to enhance their platforms used by data scientists and customers to reduce delivery time and improve outcomes on one-off projects. As this becomes more robust and no validated use cases begin to pull the business toward solution orientation, then it is possible to shift into the AI Platform quadrant.

Positioning Example: Anodot | Autonomous Analytics. Only the alerts you need. Just when you need them. We use AI to constantly monitor and forecast business performance. We have your back, so you can grow your business.

Conclusion

Four Quadrant Positioning Analysis is a flexible tool that product strategists need to consider as an added perspective when analyzing markets. While simple to conceive, forcing you to focus on key attributes of competitors and grouping them together yields insights that may be otherwise hidden.

Once market participants are placed in the matrix, one can uncover the motivations and constraints driving positioning from others in the market. For your own business, analysis models can help you to contemplate strategies to outmaneuver your competition, both how to position and where to invest. Just don’t expect them to provide answers — they only shed light on what needs to be considered.